Tax Intelligence. Precise Accounting.

Dedicated to Your Financial Success.

At HTS Accounting & Tax, we are committed to providing comprehensive analysis and forward-thinking tax strategies that align with your business goals. We don’t just manage your numbers — we help you leverage them.

As your strategic advisor, we approach every engagement with precision, urgency, and insight. Our goal is simple: to give you the clarity and bandwidth to focus on what truly adds value — expanding your business and realizing your vision, while we handle the complexities of accounting and tax compliance.

Services we offer

Accounting &

Bookkeeping

Business owners have plenty of tasks on their plate. HTS has a team of professionals that can alleviate work related to maintaining bookkeeping and accounting records. Allow us to worry about the numbers to allow you to focus on growing your bottom line!

Comprehensive Business Solutions

HTS assists with business formation, guiding you through selecting the right structure and completing all required filings. We also act as your registered agent, ensuring compliance with state regulations, managing legal correspondence, and keeping your business in good standing year-round.

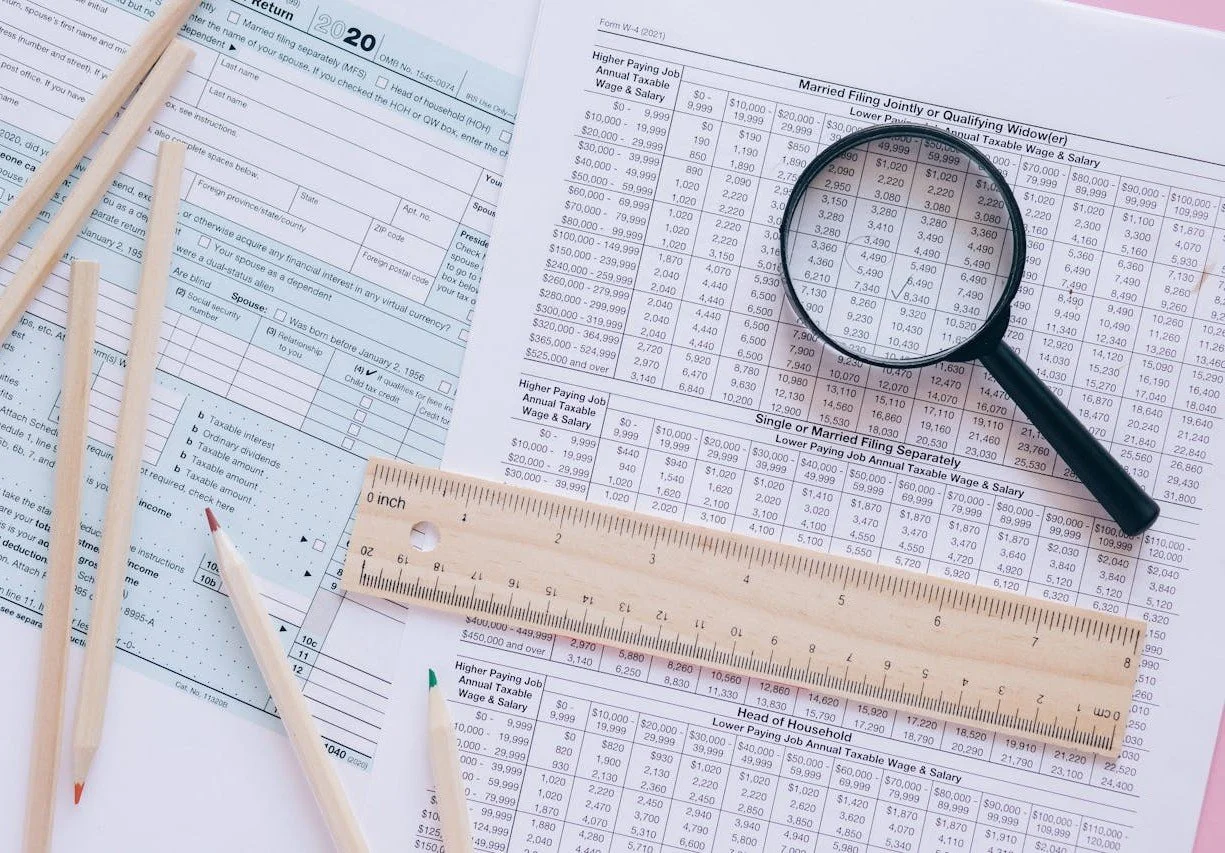

Income Tax Compliance - Business

Corporate and partnership tax returns result in unique and complex issues. Our team of professionals have decades of experience in preparing S-Corp, C-Corp, and 1065 returns. We take confusion out of the equation by handling the intricacies of your business tax obligations.

Income Tax Compliance - Personal

We provide expert tax advice to individuals, ensuring you obtain the most efficient tax outcome. We help identify deductions and credits to minimize your tax burden. Whether simple or complex, we tailor our approach to meet each client’s unique financial situation.

Income Tax Compliance - Estate / Trust

Our team can help you navigate the reporting requirements for estates and trusts, ensuring proper filings, minimizing tax liabilities, and providing comprehensive tax reporting services for fiduciaries and beneficiaries alike.

Income Tax Compliance - Nonprofit

We assist non-profit organizations with filing tax returns, ensuring compliance with IRS and state requirements. We help maintain tax-exempt status, manage reporting obligations, and provide guidance on financial disclosures to support transparency and accountability.

Audit Defense Resolution

The HTS team can assist you in ensuring all notices are handled in an efficient manner with minimal stress. HTS’ lead partner is an attorney ready to advocate on your behalf with the IRS.

Payroll Reporting

Our team offers full-service payroll solutions to keep your business compliant and efficient. We handle payroll processing, tax withholdings, and federal and state tax filings including Form W-2 and 1099 reporting.

Sales & Use Tax

We provide monthly and quarterly sales and use tax return preparation for all state jurisdictions. We also provide review of historical returns for accuracy and work with clients to obtain refunds where applicable.

Navigate the intricate world of taxes with unparalleled expertise by booking an appointment with our distinguished advisors. Secure peace of mind and elevate your financial strategy with personalized, meticulous tax planning tailored just for you.